4. Mind the gap

In this chapter, some social statistics are given about the tax revenue and the tax structure and about income inequality.

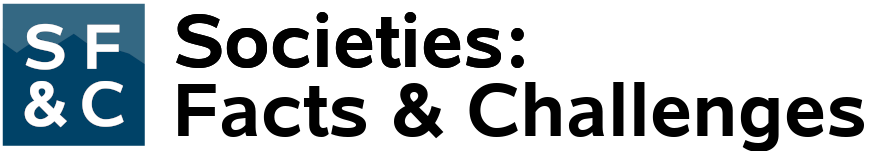

4.1 Tax revenue and tax structure of Belgium compared to OECD average

The first figure shows the total tax revenue as share of GDP (the tax-to-GDP ratio) in 2020 for Belgium (other countries can be added in the top left-hand corner). The second figure shows the evolution between 2020 and 2021.

Source: OECD (2022), Revenue Statistics 2022: The Impact of COVID-19 on OECD Tax Revenues, OECD Publishing, Paris, https://doi.org/10.1787/8a691b03-en.

Source: OECD (2022), “Tax to GDP ratios in 2020 and 2021p (as % of GDP)” in Revenue Statistics 2022: The Impact of COVID-19 on OECD Tax Revenues, OECD Publishing, Paris, https://doi.org/10.1787/8a691b03-en

Source: OECD (2022), Revenue Statistics: Key findings for Belgium, OECD Publishing, Paris, https://doi.org/10.1787/8a691b03-en.

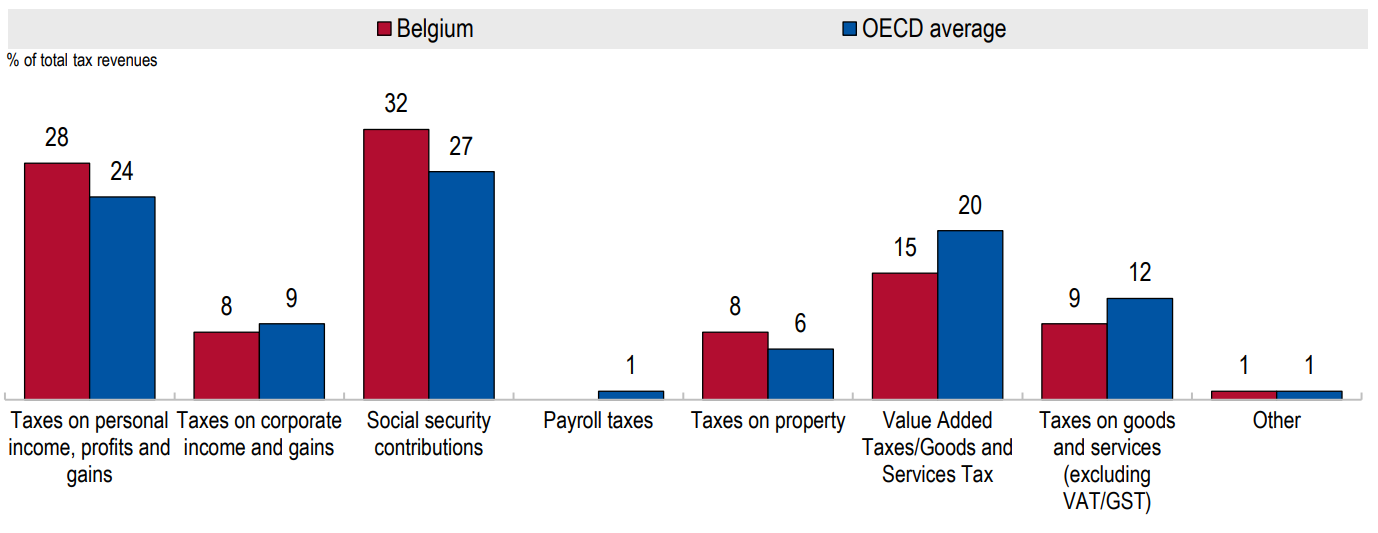

4.2 Total tax revenue and tax structure in some African countries

Source: Tax Foundation (2020), https://taxfoundation.org/africa-tax-revenue-oecd-report-2020/, (accessed 31/01/2023)

Source: Tax Foundation (2020), https://taxfoundation.org/africa-tax-revenue-oecd-report-2020/, (accessed 31/01/2023)

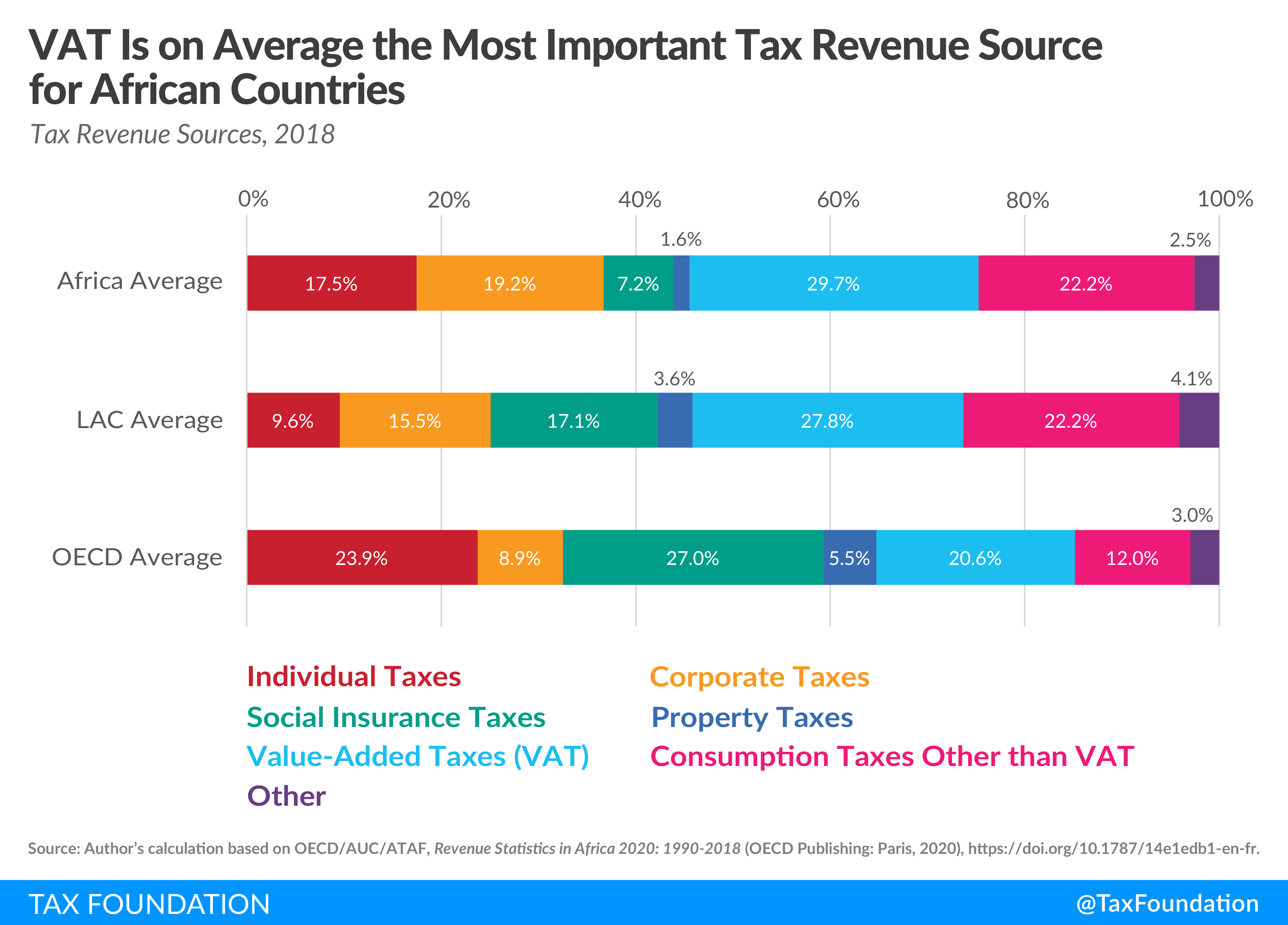

4.3 Income inequality within countries and the world

Yearly income per person (in PPP-adjusted 2005 $), by region of the world

ⓘ Farcaster, CC BY-SA 4.0, via Wikimedia Commons, Adaptation of Lakner, C., & Milanovic, B. (2016). Global Income Distribution: From the Fall of the Berlin Wall to the Great Recession. The World Bank Economic Review, 30(2), 203-232.